The Single Strategy To Use For Paypal Business Loan

Table of ContentsUnknown Facts About Paypal Business LoanThe 30-Second Trick For Paypal Business LoanHow Paypal Business Loan can Save You Time, Stress, and Money.More About Paypal Business Loan9 Easy Facts About Paypal Business Loan ExplainedIndicators on Paypal Business Loan You Need To Know

Several organization owners report feeling emphasized when using for a small service funding. Understanding which documents will certainly be called for and getting that documentation in order prior to you apply for your service loan can lower your stress and anxiety and also speed-up authorization of your funding.Be prepared to supply up to 2 years of background. Not all lending institutions will require two years on all files, but lots of will certainly not need more than that. PayPal Business Loan. Regardless, be prepared to provide all requested documentation.

Some Known Details About Paypal Business Loan

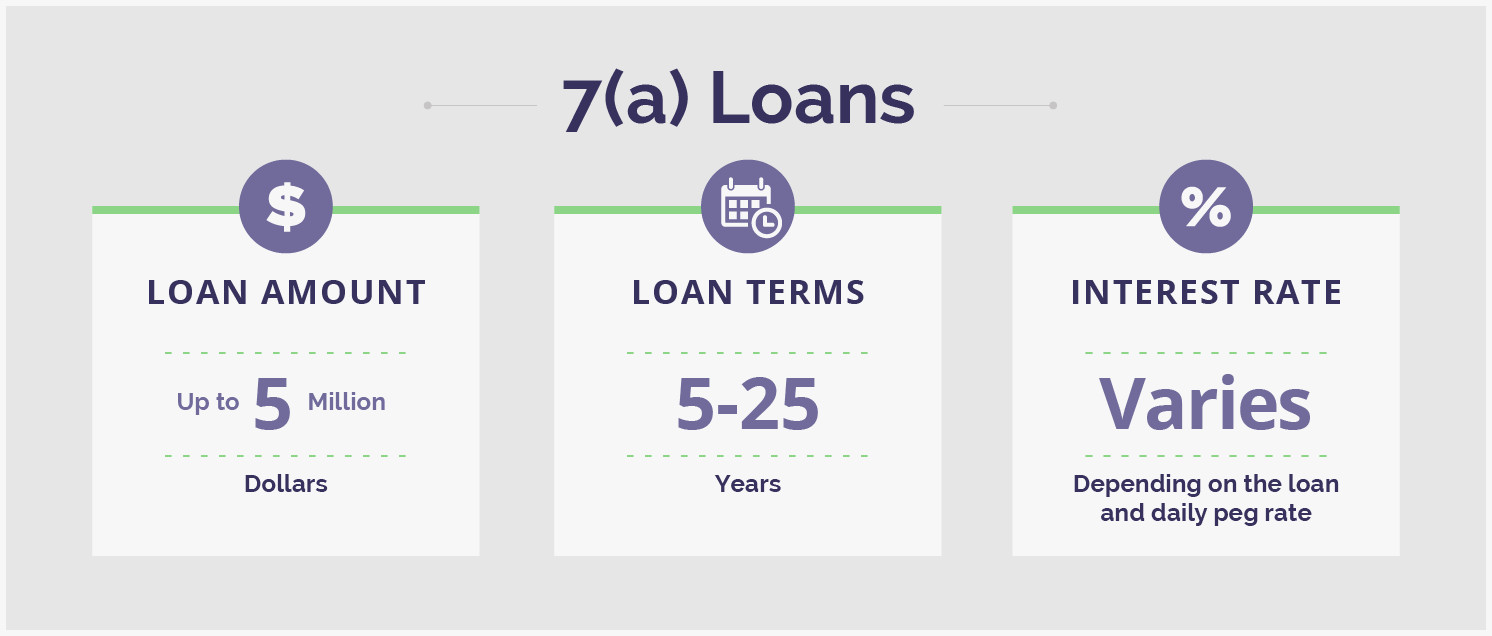

However you can select from a selection of company car loan types and should research your alternatives to find the finest fit. Take into consideration the sorts of small-business financings you can pick from: SBA fundings. The SBA partly backs fundings from providing companions, lowering their danger as well as enhancing accessibility to resources for local business.

Tools financing is a kind of term lending that can be utilized to purchase and spread out the price of equipment or equipment for your company. Typically, the devices is collateral for the loan. If your local business fights with capital due to the fact that you're waiting on invoices to be paid, you can utilize invoice financing, additionally referred to as factoring.

A Biased View of Paypal Business Loan

Certain energy-efficient or making tasks may get approved for more than one 504 finance of up to $5. 5 million each. These low-interest finances made straight by the SBA can visit here be utilized to recuperate from a stated calamity. Companies might utilize calamity loans to fix or change machinery as well as tools, inventory, and also actual estate that was harmed or destroyed.

Lots of small-business loans can be used for a range of service needs. Small-business loan applications are based in component on credit scores, as well as there are few finance alternatives for businesses with poor credit report.

Some on the internet lenders are taken into consideration alternative lending institutions, which can provide even more adaptability than commercial banks since their loan products are much less managed. Different lenders provide car loans to borrowers that otherwise might not have accessibility to small-business financing, such as startups or organizations with a shaky monetary history."Tiny services ought to be mindful there are multiple networks available for obtaining needed funds," claims S.

Online lenders may lending institutions Might supply programsFunding

For example, you could obtain a different finance for payroll than you would for genuine estate. If a lending institution does not provide loans in the amount you require, discover one that will. Choosing a lower quantity can concern you with a lending that falls brief of adequately resolving your resources demands.

Indicators on Paypal Business Loan You Need To Know

Short-term business loans have greater month-to-month repayments than long-term lendings, however you will normally pay less in complete interest because you have the financing for much less time. The opposite is also real. A over at this website longer settlement term can imply lower monthly settlements yet more in complete rate of interest charges over the life of original site the funding.

Look for a loan provider with the most affordable costs, consisting of: The interest rate is the interest charged on your lending yearly, plus all fees as well as expenses related to the finance. Remember that promoted rates of interest might be where prices begin; a rate check can approximate an APR for your small-business loan.

In some instances, the down repayment for your small-business lending is covered by collateral. Various other small-business finances need an equity investment. Deposit needs differ, however anticipate to spend at the very least 10% to 30% of your own capital when obtaining a finance. Variable price. A variable rate is normally used for merchant cash loan and short-term business fundings to determine just how much you will certainly owe in interest.

The Buzz on Paypal Business Loan

Personal fundings (PayPal Business Loan). Household fundings.

Marketing considerations may impact where offers appear on the website yet do not affect any content decisions, such as which funding products we cover and also how we assess them. This website does not consist of all lender or all funding supplies readily available in the industry.

In some cases, a tiny organization financing is the answer to help you attain your organization goals. Before you begin submitting applications, though, you'll desire to have a fundamental understanding of the small organization car loan landscape: what funding options are offered, which ones are preferred, and also how they work. In this overview, we'll cover those fundamentals and some choices worth considering.